| Total wealth | Population | Wealth/head | People capped | Wealth capped | Windfall | ||||

|---|---|---|---|---|---|---|---|---|---|

| Country: | (billions) | (millions) | (1000s) | (persons) | % | (billions) | % | (billions) | % |

| Argentina | $467 | 43 | $11 | 1,512 | 0.004% | $75 | 16% | $54 | 12% |

| Australia | $6,428 | 23 | $283 | 28,125 | 0.12% | $770 | 12% | $486 | 8% |

| Austria | $1,408 | 8 | $166 | 7,169 | 0.085% | $221 | 16% | $147 | 10% |

| Belgium | $2,293 | 11 | $210 | 5,872 | 0.054% | $140 | 6% | $81 | 4% |

| Brazil | $2,537 | 204 | $12 | 11,184 | 0.006% | $706 | 28% | $489 | 19% |

| Canada | $7,564 | 36 | $212 | 33,976 | 0.095% | $1,000 | 13% | $655 | 9% |

| Chile | $602 | 18 | $33 | 3,238 | 0.018% | $196 | 33% | $137 | 23% |

| Czechia | $409 | 11 | $39 | 1,926 | 0.018% | $105 | 26% | $75 | 18% |

| Denmark | $1,100 | 6 | $199 | 7,135 | 0.13% | $210 | 19% | $138 | 13% |

| Finland | $622 | 5 | $114 | 3,025 | 0.056% | $115 | 18% | $82 | 13% |

| France | $11,891 | 64 | $186 | 47,717 | 0.075% | $1,380 | 12% | $896 | 8% |

| Germany | $12,419 | 81 | $153 | 60,700 | 0.075% | $2,019 | 16% | $1,385 | 11% |

| Greece | $947 | 11 | $84 | 2,545 | 0.023% | $79 | 8% | $53 | 6% |

| India | $3,099 | 1,302 | $2 | 13,631 | 0.001% | $1,310 | 42% | $771 | 25% |

| Ireland | $770 | 5 | $157 | 3,837 | 0.078% | $124 | 16% | $84 | 11% |

| Israel | $909 | 8 | $115 | 5,790 | 0.074% | $285 | 31% | $206 | 23% |

| Italy | $9,973 | 61 | $165 | 36,627 | 0.060% | $1,112 | 11% | $737 | 7% |

| Japan | $24,070 | 126 | $192 | 55,776 | 0.044% | $1,351 | 6% | $792 | 3% |

| Korea (South) | $6,278 | 49 | $128 | 25,055 | 0.051% | $829 | 13% | $567 | 9% |

| Netherlands | $2,412 | 17 | $142 | 8,364 | 0.049% | $240 | 10% | $155 | 6% |

| New Zealand | $995 | 5 | $221 | 3,444 | 0.076% | $87 | 9% | $52 | 5% |

| Norway | $1,195 | 5 | $237 | 6,720 | 0.13% | $213 | 18% | $143 | 12% |

| Poland | $746 | 38 | $20 | 1,825 | 0.05% | $73 | 10% | $52 | 7% |

| Portugal | $667 | 11 | $62 | 2,049 | 0.019% | $69 | 10% | $48 | 7% |

| South Africa | $650 | 52 | $13 | 2,429 | 0.005% | $115 | 18% | $83 | 13% |

| Spain | $4,396 | 47 | $93 | 14,635 | 0.031% | $493 | 11% | $340 | 8% |

| Sweden | $1,683 | 10 | $177 | 11,640 | 0.12% | $419 | 25% | $294 | 17% |

| Switzerland | $3,478 | 8 | $449 | 22,511 | 0.29% | $672 | 19% | $443 | 13% |

| Taiwan | $3,199 | 23 | $139 | 16,399 | 0.071% | $652 | 20% | $466 | 15% |

| UK | $14,150 | 64 | $222 | 59,318 | 0.093% | $1,631 | 12% | $1,033 | 7% |

| USA | $84,784 | 334 | $254 | 939,080 | 0.28% | $24,920 | 29% | $15,470 | 18% |

UK data suggests that 60,000 people (the top 0.1%), each owning over $10 million of wealth, collectively own about $1.6 trillion of net wealth (12% of the national total) and that a wealth cap of $10 million (note dollars) would get the UK state a one-time windfall of about $1 trillion, i.e. about 2/3 of the wealth of the top 0.1% (and 7% of the national total). The windfall would be enough to either drastically reduce government debt (if it was all liquid -- unlikely) or set up a sovereign wealth fund larger than Norway's, perhaps devoted to pensions or to the National Health Service. An NHS fund may be the most politically palatable and durable option. At worst, the (liquid part of the) fund could be used to withstand any turbulence caused by implementation of the cap.

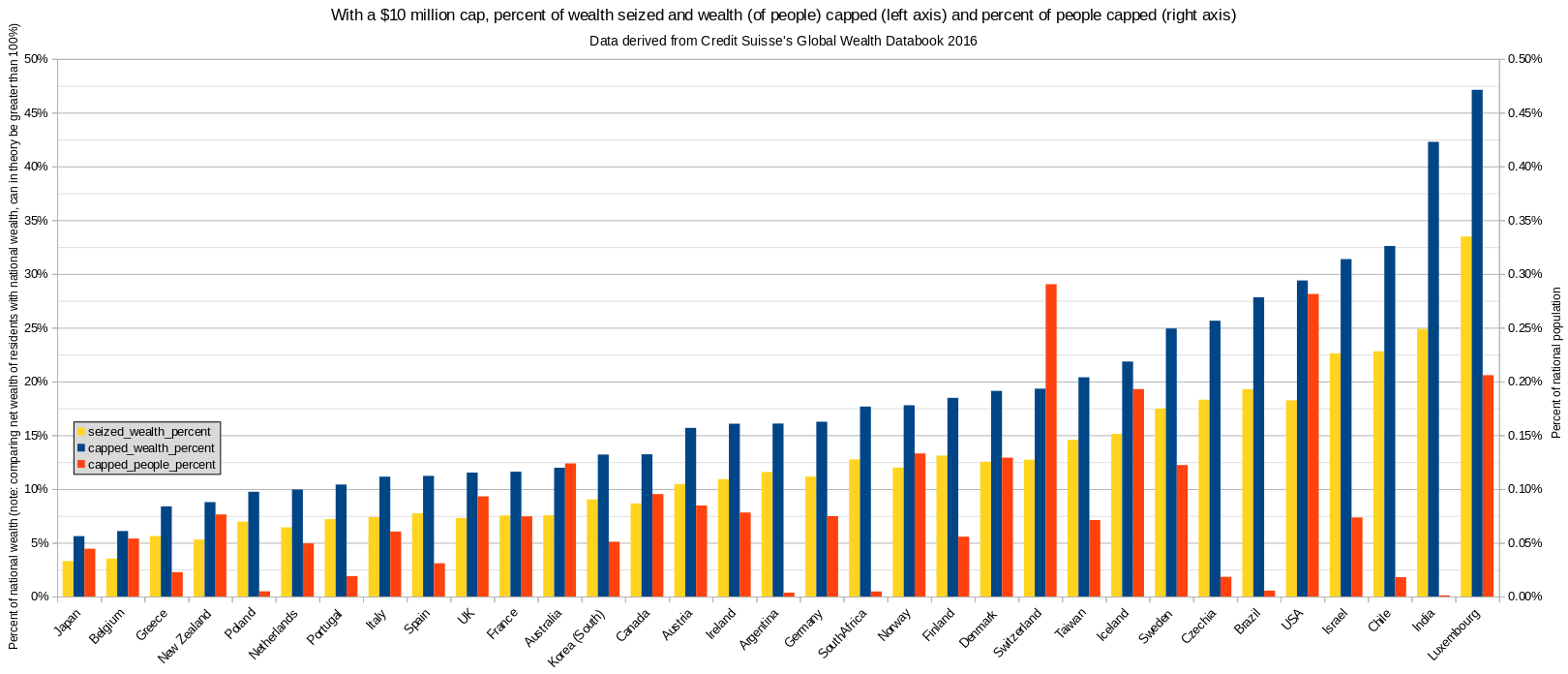

Across the developed countries, the proportion of the population directly affected by the wealth cap (as individuals, not households) is of the rough magnitude of 0.1% (1 in 1,000), ranging from around 0.03% (1 in 3,000) for Spain to around 0.3% (1 in 300) for the USA and Switzerland, with the Scandinavian countries and Australia at around 0.125% (1 in 800), and most of Western Europe between 0.05% and 0.1% (1 in 2,000 to 1 in 1,000). For the developing countries, the proportion is around 1 in 20,000, but around 1 in 100,000 for India.

Among developed countries, the most tempting prospects, in terms of windfall, for a wealth cap are the USA and Sweden, with about 18% of national wealth for the taking, and Israel with 23% (!!). In Central and Northern Europe, the amount is around 10% to 12% of national wealth. Other anglophone and Western European countries have about 5% to 9% available. Of the developing countries, India seems the most extreme, with a minority of 1 in 100,000 of the population owning 42% of all the wealth, with 25% available from a $10 million wealth cap.

The most important country for a wealth cap is the USA, with 60% of all those with more than $10 million living there (around 1 million of the world total of 1.6 million).